When I bought my cleaning robot, I have chosen Roborock S7 instead of S6-Max or S5-Max because I knew it is the model that can pair with Roborock auto-empty dock.

In fact, I find it quite difficult to empty out the dust in the Roborock S7 dust box because the debris can be trapped in quite a lot of places inside the dust box. The only effective way to quickly empty it out is to vacuum out the debris, which is exactly what the Roborock auto-empty dock function to do. As such, I suspect that the dust box is designed that way to entice people to buy its auto-empty dock to make life easier.

Currently, there are already 3 generations of Roborock auto-empty dock:

- The 1st generation can only work with disposable 1.8 litre dust bag, which can easily hold debris for more than a month.

- The 2nd generation has a cyclone separator unit to collect debris into its dusbin without dust bag. Alternatively, it can also work with the disposable dust bag by replacing the cyclone separator in it with the dust bag components.

- The 3rd generation, not available to S7 yet, is able to automatically refill the robot's water tank and clean the robot's mopping cloth, besides emptying out the debris from the robot's dust box.

If you intend to buy a Roborock auto-empty docking station, I strongly encourage you to buy the 2nd generation that comes with both the cyclone separator and also the dust bag holder and disposable dust bag. I bought it at the price of slightly above RM1,600 in

Banggood online shop.

The Roborock auto-empty dock has 2 colour selections: black and white. The Roborock S7 cleaning robot also has black and white selections.

I find that mixing the colour between the robot and its auto-empty dock also looks nice and would not cause any dissonance. Here is my white Robock S7 and its black auto-empty dock.

You can see that I have already replaced its cyclone separator with its disposable dust bag unit. In this way, I don't need to clean its dustbin, as all the debris will be stored inside the 1.8L dust bag.

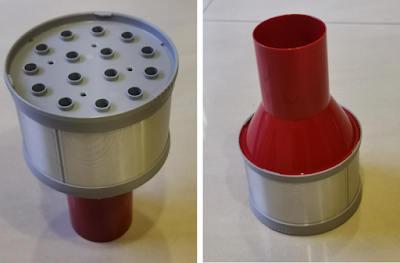

Its cyclone separator looks like lotus seedpods. The Roborock auto-empty dock user manual has the instruction to change it with the dust bag unit, and vice-versa.

The Roborock auto-empty dock comes in 2 pieces after unboxing, which we need to assemble its body onto its base by screwing 5 screws that are marked with the screwdriver sign. An L-shape screwdriver is available at the base for that purpose.

The Roborock auto-empty dock comes with a dust box with an air-inlet, to replace the one in the S7. You will need to remove a lit that covers the air-inlet window in the S7 robot too. Detail instruction is given in the user manual.

The debris in the robot's dust box is sucked into the left cylinder of the dock station, and then settles down in the right cylinder, either in its dust bag or directly in the dustbin.

There are 2 filters inside the left cylinder, namely the rear HEPA filter and the front cup filter, both are removable and washable.

After the Roborock S7 robot made its first docking onto this auto-empty docking station, you will find additional functions for this auto-empty dock in the Roborock mobile apps.

The left button at the bottom of the main page has changed to "Empty Dustbin".

There is also an

Auto-Empty Settings menu option, in which you can set the empty mode to be either smart, light, balanced, or max.

When assembling this Roborock auto-empty dock, I was amused by its state-of-the-art brilliant and beautiful design, which is a combination of engineering, art, practicality, hygiene, and user experience. It's just amazing. You could be feeling the same when you assemble a unit too.

Note that when the robot is docked onto this auto-empty docking station, it is pretty tightly "sucked" on it and not manually removable, unless by force, which is a big no-no.

If you want to bring the robot to another place for multi-floor cleaning, you can detach it from the docking station by using the Remote Control function in its mobile app. Just control it to move backward, and it will come out from its docking station.

In certain countries, Roborock has bundled them together as S7+. If you see the S7+ model, it is actually an S7 rebot that comes together with its auto-empty dock. But, you need to beware that the auto-empty dock in the S7+ might be of the first generation, without the cyclone separator.