If you want to have a common charger for multiple devices that charge using USB cable, and better still, to be able to charge multiple devices at the same time, then you can look for a multiport charger such as this UGREEN CD226.

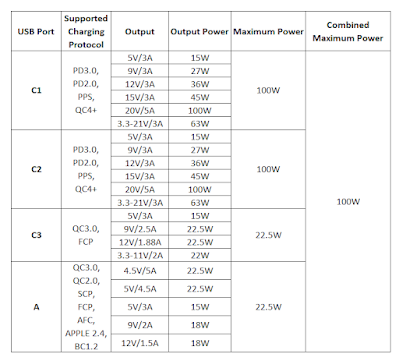

The UGREEN CD226 is a 4-ports charger that supports fast charging (or quick charging / super charging) of various protocols including PD3.0, PD2.0, PPS, QC4+, QC3.0, QC2.0, FCP, SCP, AFC, etc.

You can feel that this Gallium Nitride (GaN) charger is quite big (compared with those single port charger) and quite heavy. Holding it is like holding a tennis ball.

Anyhow, if it is not using the modern Gallium Nitride (GaN) technology, it might have been even much more larger in size.

It has 3 USB-C charging ports and 1 USB-A charging port. Its maximum charging power is 100W. You can use one or more ports at the same time to charge your device(s) simultaneously.

It is compatible with many devices (handphone, smart watch, tablet, game station, ear phone, and even laptop).

If you connect your device to the right charging port, it supports the fastest charging speed compatible with your device's USB port. However, if you connect your device to a non-compatible fast charging port, it can still charge up your device without problem, but with a slower charging speed.

Port C1 and C2 have the same specs that support a maximum charging power of 100W. You should try charging your device with either one of these 2 ports first. If you are unable to get fast charging, then try port C3, followed by port A.

It supports products of multiple brands, including but not limited to iPhone, iPad, MacBook, Dell XPS, Asus, Lenovo, HP, Surface, Huawei, Honor, Samsung, Xiaomi, Vivo, Nintendo Switch, etc.However, it does not support the latest 100W super charge protocol of my Honor Magic 4 Pro handphone. I can still use it to charge the Honor Magic 4 Pro, but the charging speed is much slower, compared with charging using the handphone's original supercharge charger.

Same with most other modern chargers, the UGREEN CD226 has protection mechanisms to prevent overheat, overvoltage, overcharge, etc.