Have you ever made a simple evaluation on which models of car can you afford with your monthly fixed income?

Or, in other words, if you already have a car model that you want to buy, how much salary do you need to earn so that you can pay for its monthly loan instalment without too much financial stress?

I recently shared a simple evaluation result in the Little Red Book (a.k.a. Xiao Hong Shu) and have received overwhelming likes and discussions on that article.

Now, I've decided to share the same piece of information here, in English, with my fellow readers on this blog.

The formula is pretty simple: your monthly car instalment should not exceed 1/3 (one-third) of your net monthly fixed income. 33.33% should be the maximum level you can go, which is also a level that you can most probably secure a hire purchase loan from the bank without much problem. Of course, if you can lower this proportion to 25%, 20%, 15%, 10%, or even 5%, you will be even more healthy in your monthly cash flow.

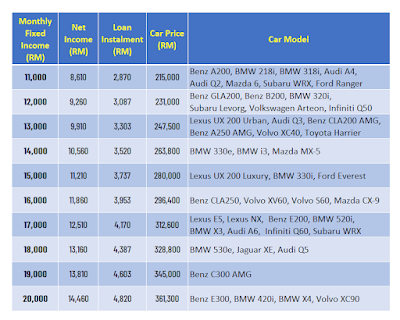

With that, with can then calculate the corresponding car price. From the car price, we will know which models of car can you afford.

Here is the result:

- Net income = Salary - EPF contribution - SOCSO - EIS - income tax PCB

- Employee's portion of EPF contribution = 11%. Although currently the employee can opt to contribute only 9% monthly to EPF, we use the normal rate at 11% for this budgeting purpose.

- Car loan instalment upper limit = 1/3 of net income

- Car loan assumption: taking 90% loan, at interest rate of 3.5%, 7 years instalment plan.

- Car price (the 4th column in the table) is calculated based on the assumptions and conditions above.

- Car model is the lowest specs new car model with current market price near to the car price in the 4th column. In other words, you are affordable to buy the models in the same row and also those in all the rows above it.

- How much housing loan can you afford with your monthly fixed income?

- Which handphone can you buy with your monthly fixed income?

No comments:

Post a Comment