Typically, there are 2 types of loans. One is fixed interest rate type, and another is variable interest rate type.

Some examples of fixed interest rate loan are: car loan, personal loan, credit card loan, study loan, business loan, etc.

Since the interest rate is fixed throughout the loan tenure, you can calculate its total interest using the simple interest formula of P x R% x T. The total loan repayment amount will then be principal plus total interest. The installment amount will be total repayment amount divided by no. of installments.

Variable interest rate loan has its interest calculated daily (daily rest), monthly (monthly rest), or other predetermined interval period. Property loan is normally of this type.

For this type of loan, since the interest rate in the future is unpredictable, the actual interest saved from early settlement is also unpredictable until the time has reached its original repayment end date. If we fix the last interest rate before the early settlement made for the rest of the original tenure, then the interest saved can be estimated using the simple interest formula above. Just substitute P with the early settlement amount will do.

The rest of this article will focus on how much we can save from early settlement of fixed interest rate loan.

The interest saved is usually called interest rebate, and is calculated according to the rule of 78. For Islamic loans, it is calculated according to the formula of Ibra'. Basically, both formulae are identical.

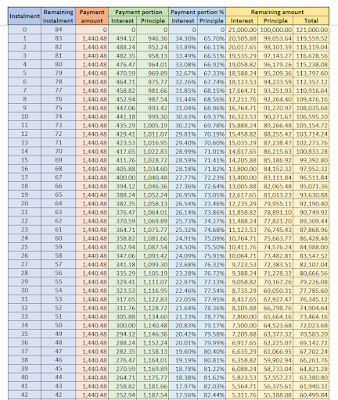

As an example, let's say a 7 years loan with principal 100k, 3% interest per annum, if we fully settle it 3 years after the borrowing, how much interest rebate can we get back?

Principal = 100k

Interest = 100k x 3% x 7 = 21k

7 years total repayment = 100k + 21k = 121k

Monthly installment = 121k/84 = 1440.476, rounded up to 1440.48

Since there is a round up of 0.004 for every installment, the last installment will then be 1440.16 only.

The sequential sum of all installment no. = 1+2+3+...+82+83+84 = (84)(84+1)/2 = 3570

According to rule of 78:

Interest for installment no. 1 = 21k x 84/3570

Interest for installment no. 2 = 21k x 83/3570

Interest for installment no. 3 = 21k x 82/3570

and so on...

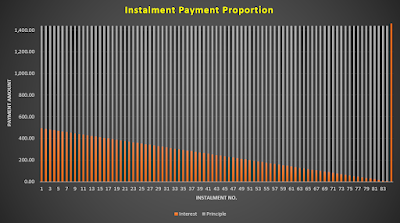

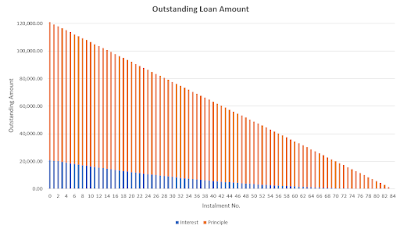

Putting all the above information into an Excel worksheet, we can produce the following...