During the recent 11.11 big sale promotion festival, I have purchased a CCKO brand (model CK9919) 20 litres stainless steel smart rechargeable sensor garbage bin to be used in my kitchen. Its price was around RM170 after discount.

It is "smart" in the sense that it can automatically open its lid whenever its infra-red sensor detects an object near its top, then start a 5 seconds countdown after the object is cleared, and then automatically close back its lid.

You can see it in action in the video below:

Besides infra-red object detection, its lid can also be automatically opened by slight vibration to the bin (such as gently kicking its body) or by pressing a button on its top panel.

In this way, you can throw your rubbish into it without touching any part of the garbage bin. Convenient and hygienic.

There are other even smarter models of garbage bin available in the market. Some can even automatically wrap up the garbage bag inside when it is full, and automatically reload a new garbage bag after the existing used one is taken away. However, those types of smarter garbage bin require the use of their own special garbage bag (which is not cheap), and their price is higher too. Therefore, I did not choose those smarter type.

There are quite a number of different sizes available for CCKO elegant stainless steel garbage bin. In terms of shape, there are also 3 choices: round cylinder, rectangular and square.

For kitchen use, I found the rectangular type is more space-saving, and the size of either 15 litres or 20 litres is more suitable. Both the 15 litres and 20 litres have the same base size of 30cm x 22cm. Their difference is on the height: 20L one has a height of 50.5cm whereas 15L one is 39.5cm.

You can use smaller size one for living room, bedroom, writing desk, toilet, etc. accordingly.

The CCKO smart garbage bin consists of 3 parts: the stainless steel outer bin, black colour plastic inner bin, and its cover. Just like normal garbage bin, you can put garbage bag inside the inner bin to collect your rubbish.

This CCKO garbage bin comes with a user manual, a QC certificate, a USB charging cable, and 3 sample garbage bags. The user manual is written in Chinese.

Its actual opening available for you to throw rubbish is approximately 25cm x 13.5cm only.

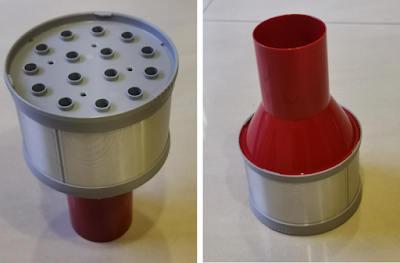

The magic is played by its cover, with sensors and electronic motor to open and close its lid. It is powered by a 1,500 mAh rechargeable 18650 lithium-ion battery. The size of this 18650 battery is larger than AA size battery.

Charging can be done by connecting the round connector of its charging cable to its charging port, and the USB end to either a wall charger or a power bank. It is said that a single charge can last for more than a month operation.

When you take out the cover and turn it over, you can find 2 compartments. One is the battery compartment, and the other compartment is used to place a bag of activated carbon to remove bad odour.

I like this garbage bin very much. It is smart. Its stainless steel body looks solid, classy and elegant. It is easy to use.

More importantly, this CCKO CK9919 garbage bin is water-resistant, protecting its electronic parts from damage being splashed by liquid. I did read some online reviews to some of its cheaper counterparts without water-resistant feature that those garbage bin will stop working after some time, probably due to electronic parts damaged by liquid.