As I mentioned before, Rakuten Trade has a handy and useful Stock Screener function which includes Detailed Analysis powered by Thomson Reuters.

You can use this link to open a new Rakuten Trade account for free.

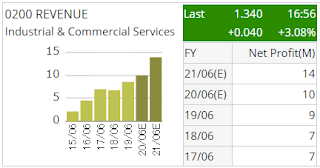

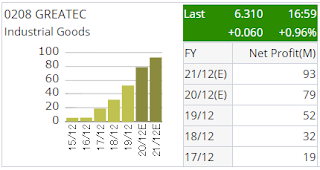

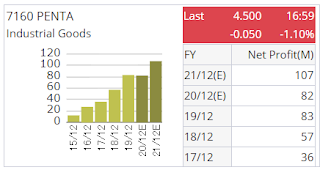

We can find the following 38 stocks with net profit chart that shows continuous growth over the recent years and forecasted to continue growing in the upcoming 2 years, by a quick screening through the Detailed Analysis. This is useful to perform initial filtering for investment stock picking.

Among the 38 stocks, 32 of them show consistent continuous net profit growth, while I opined that another 6 worth to add into this list although their graph is not as perfect as the 32.

The 32 stocks, sorted by their counter number, are as follow. Note that the price information at the top right corner of the graphs is the last matched price before market closing on Wednesday 19 August 2020.

0001 SCOMNET

0002 KOTRA

0021 GHLSYS

0037 RGB

0080 STRAITS

0128 FRONTKN

0169 SMTRACK

0176 KRONO

0200 REVENUE

0208 GREATEC

0215 SLVEST

0218 ACO

0219 RL

0220 OVH

0221 TCS

03017 UNIWALL

3034 HAPSENG

4731 SCIENTX

5008 HARISON

5077 MAYBULK

5102 GCB

5156 XDL

5279 SERBADK

7013 HUBLINE

7029 MASTER

7084 QL

7160 PENTA

7181 ARBB

7277 DIALOG

9296 RCECAP

9687 IDEAL

9792 SEG

and the other 6 stocks are:

5250 SEM

5292 UWC

7034 TGUAN

7091 UNIMECH

7148 DPHARMA

7153 KOSSAN

Disclaimer: This article is intended for sharing of point of view only. It is not an advice or recommendation to buy or sell any of the mentioned stock counters. You should do your own homework before trading in Bursa Malaysia.