BigPay is an e-wallet operated by AirAsia. It has a large stored-value capacity of up to RM10,000.

BigPay is especially beneficial to frequent travelers who fly with AirAsia flights. You can not only save money on your flight booking, and also save money when you spend in foreign currency.

You can also make use of the BigPay Mastercard to withdraw money from ATM machine overseas, so you need not to carry too much bank notes with you.

You can download the BigPay mobile app from Google Play Store and/or Apple iTune App Store.

One of the common problems faced by e-wallets is their acceptance coverage by merchant outlets, which takes a lot of time and effort to build up the network. If the e-wallet is not commonly accepted as payment method in most of the shops, it will in turn face difficulty in getting users to use it. This is a chicken and egg problem.

BigPay smartly overcome this problem by partnering with Mastercard. Each BigPay account will be issued with a Mastercard prepaid card, which linked with the BigPay e-wallet, and can be used in all credit card terminals that accept Mastercard. In this way, BigPay leverages on the huge network of Mastercard and can be used in all of the shops that accept Mastercard payment. What a brilliant idea!

The BigPay Mastercard is a prepaid card which will deduct money from your BigPay e-wallet when you use it. It supports the traditional magnetic swipe (for use in overseas when the terminal only support this kind of card payment method), smart chip with 6-digit PIN for payment confirmation, and also PayPass contactless payment.

You can also make use of this BigPay Mastercard to withdraw money from your e-wallet at the ATM machine of partnering banks, both in Malaysia and overseas. Withdrawal of money from BigPay using local ATM will cost RM6.00 per transaction, and withdrawal from foreign ATM will cost RM10.00 per transaction or 2% of the withdrawal amount, whichever is higher.

The joining fee to become a BigPay member is RM20. Anyhow, this RM20 will be credited back into your e-wallet and made available for use. So, technically speaking, there is no cost to join BigPay. It just needs an initial loading of RM20 into your e-wallet.

Among the advantages of using BigPay are:

- Option to use mobile app and QR code for payment, or to use the physical Mastercard.

- Worldwide accepted and can be used at any terminal or online platform that accepts Mastercard.

- No annual fee for both the e-wallet and the Mastercard.

- No annual government SST as it is a prepaid card. All credit cards and debit cards issued in Malaysia are subject to SST annually.

- Money can be withdrawn using ATM machine, locally and also internationally.

- When making payment or cash withdrawal in foreign currency, there is no expensive surcharge to the currency conversion rate. The conversion rate is very close to the one published in XE.com.

- Collect AirAsia BIG Points when you spend with BigPay.

- Reload your e-wallet with cash rebate credit cards and enjoy your cash rebate with those cards.

- Earn referral reward of RM10 per new account activation using your unique referral code.

Note that the first time you use your physical BigPay Mastercard, you need to key-in your PIN at the terminal. After that, you can choose to use the contactless payment method without the need to enter your PIN.

Below is the product disclosure sheet of BigPay (click image to enlarge).

On top of the above advantages, as a BigPay member, you can also enjoy the following benefits when buying air tickets from AirAsia:

- No processing fee. (AirAsia will charge processing fee if you pay with other brand of credit card or debit card)

- RM2 discount per pre-booked item on flight baggage and food.

- Early access to AirAsia deals, including the free air tickets offering.

- Link your BigPay account with your AirAsia BIG Loyalty account to collect your BIG Points whenever you use BigPay, as well as easily check the amount of your BIG Points from within the BigPay mobile app.

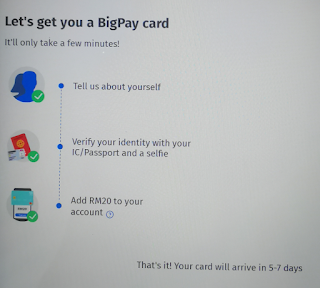

To become a BigPay member and receive your free Mastercard, you need to install the BigPay mobile app into your smartphone.

Your phone number will be verified by the BigPay app using SMS. After the verification, you will need to provide your personal information.

IMPORTANT: Make sure to key-in

IGR22QDU1C into the referral/promotion code column to get RM10 loaded into your e-wallet. If you missed this step on the above page, you will miss your opportunity to receive the RM10 from BigPay as welcome reward.

After that, you will need to take a photo of your identity card or passport, followed by a selfie photo of yourself. This procedure is a requirement from Malaysia government to all e-wallet issuers. You might have the similar experience if you have registered yourself to use other e-wallets in Malaysia. It is a bit tedious but is a strict requirement during the process to have an e-wallet.

You are also required to load RM20 into your BigPay e-wallet at the end of the process. This can be done by using online transfer from your bank account, debit card or credit card.

If you done the above process correctly, you will have RM30 (RM10 from referral code, RM20 from initial loading) inside your e-wallet by the time you receive your BigPay Mastercard by post.

Tips: if you have

Touch n Go e-wallet, you can configure your Touch n Go e-wallet to be reloaded using this BigPay Mastercard.

With the BigPay mobile app, you can use it to:

- Transfer money and receive money with your family and friends (who are other BigPay users).

- Split bill with them.

- Use QR code at merchant terminal for payment.

- Check your AirAsia BIG Points.

- Keep track on your e-wallet money usage with the built-in Analytics function.

- (upcoming function) transfer money to local banks and also international banks.

- Share out your BigPay referral code and receive RM10 from each of your successful referrals.

I also highly recommend you to also install the AirAsia BIG Loyalty mobile app from

Google Play Store and/or

Apple iTune App Store.

The AirAsia BIG Loyalty app enables you to manage your BIG Points and also allows you to redeem your points. You can also perform BIG Points exchange with other partnering loyalty programs here.

Tips: One way to earn AirAsia BIG Points without spending your money, and in a larger amount, is through

CIMB AirAsia Savers account.