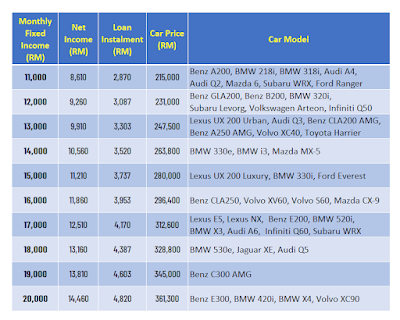

Recently, we talked about which models of car can you afford with your monthly fixed income?

Now, let's apply the same method to find out how much housing loan can you afford with your monthly fixed income, for your own residence (not for investment purpose)?

Certain residence types, such as single-storey linked house, double-storey linked house, town house, semi-D, bungalow, etc. do not need to pay monthly maintenance fee and sinking funds. Even some of the gated and guarded ones involve monthly security fee, the amount is minimal compared to those that require payment of maintenance fee and sinking funds, such as apartment, condominium, SOHO, etc.

As the maintenance fee and sinking funds is a form of monthly commitment to own the property, we need to consider these 2 commitments in our calculation.

The formula is pretty simple: your monthly house loan instalment should not exceed 1/3 (one-third) of your net monthly fixed income.

As such, for properties without maintenance fee and sinking funds, your affordability will be as follow:

- Net income = Salary - EPF contribution - SOCSO - EIS - income tax PCB

- Employee's portion of EPF contribution = 11%. Although currently the employee can opt to contribute only 9% monthly to EPF, we use the normal rate at 11% for this budgeting purpose.

- Housing loan instalment upper limit = 1/3 of net income, which is the same as your car loan instalment upper limit. If you are serving both housing loan and car loan at the same time, a maximum of 2/3 of your net income will be committed to these 2 loans.

- Maintenance fee and sinking funds: normally within the range of RM300-RM400. We take RM350 for calculation here. These 2 fees will cause a deduction of RM350 in your available fund allocation, and affect your residence affordability of about RM86.5k in selling price.

- Housing loan assumption: taking 90% loan, at interest rate of 3.5%, 30 years instalment plan. Although nowadays quite a number of financing institutions are still offering housing loan interest rate of 2.x%, and provide instalment period of up to 35 years, since we are foreseeing a hike in interest rate is happening now, it is reasonable for us to take interest rate at 3.5% for our calculation.

- Price of residence = the price of residence that you are affordable to buy for your own stay, based on the assumptions and conditions above.